Nate Matherson from LendEDU shares insight on how he’s working to conquer his student debt.

Repaying student loans can seem like an impossible feat, especially when you graduate with a lot of educational debt.

I’m one of those students who graduated owing a small fortune, so I know firsthand how challenging it can be.

In fact, when I graduated from the University of Delaware in 2016, my total outstanding student loan balance topped $55,000. I had both federal and private student loans at graduation, including private loans from Sallie Mae with interest rates exceeding 9% that my parents had cosigned for.

While I’m still working on repayment, I’ve since paid off around $30,000 of this substantial debt balance.

For those trying to repay their own loans, I thought it might be helpful if I share some of the steps that I’ve taken to significantly pay down my debt over the past three years.

1. I paid interest while still in school

For many students, loan repayment becomes a lot harder because loan balances are a lot bigger at graduation than the amount initially borrowed.

This happens because most people put their loans into deferment while in school, which means no payments are made for multiple years.

But the problem with this? Interest keeps accruing on all unsubsidized loans. Moreover, this interest is capitalized, or added onto the principal balance—which means you end up paying interest on the interest.

To make sure this didn’t happen, I got a job on campus and paid interest on my loans while in school. This allowed me to start post-graduation repayment with a lower balance than I’d have otherwise had, which made repayment easier.

2. I refinanced my student loans twice

When I graduated, some of my private loans were at very high interest rates. I refinanced them a year after graduation with the goal of reducing the rate I was paying.

Then, a year later, I refinanced again to get an even lower rate. I refinanced both my private loans as well as some of my federal student loans that were at higher rates. Refinancing federal loans isn’t right for everyone, but I wasn’t planning on using an income-based payment plan or becoming eligible for Public Service Loan Forgiveness, so it made sense for me.

When I refinanced the second time, I chose a loan with a very short repayment period. This both allows me to pay a much lower interest rate than I otherwise would have, and it also forces me to pay more every month so my loans are paid down faster. My refinanced loans have a repayment period of just five years, so I know that I have a definite end date by which the loan balance will be fully repaid.

By lowering your interest rate, refinancing alone can help accelerate the repayment process, even if you choose to continue keep paying the same amount you were before. In fact, if you pay the same amount, nothing in your budget changes after refinancing, but more extra money goes toward the principal—meaning your loan balance goes down sooner.

3. My company helps with loan repayment

My company, LendEDU, contributes $200 per month towards my student loans, as well as to the student loans of our employees. Since this benefit started in February 2016, LendEDU has contributed $8,200 towards my debt.

An increasing number of companies are offering student loan assistance— a crucial job benefit when so many people are burdened with student loan debt.

This extra money is added to the monthly payment I’m already making, so the entire extra $200 goes toward reducing the principal balance on my loan. This makes a big difference in helping reduce the total balance faster.

4. I make biweekly payments with every paycheck

Instead of paying my loans just once per month, I make a payment with every paycheck.

By making biweekly payments, I end up making an extra payment each year without really noticing. This happens for anyone who’s paid biweekly, as they get 26 paychecks over the course of a year—which adds up to 13 payments instead of the 12 they’d make if they paid just once a month.

Since the same amount comes out of each paycheck, it’s easy to budget for, and making the extra payment isn’t a hardship. It’s also much simpler and easier to budget for than writing an extra check with a full extra payment once per year would be.

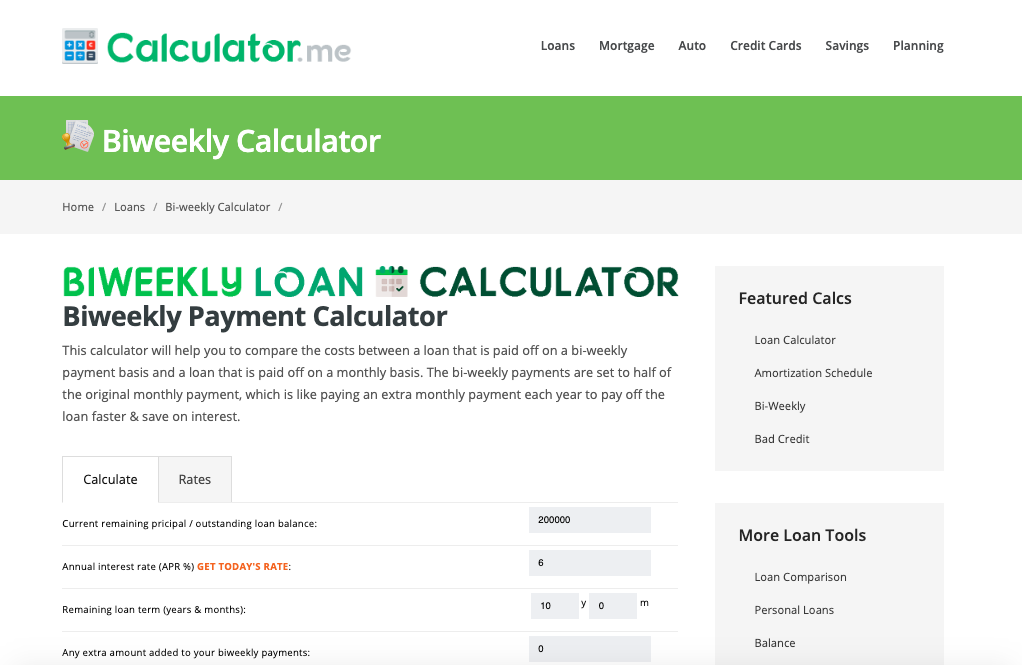

If you’re wondering how the difference between making biweekly payments versus monthly payments looks, try this helpful payment calculator from Calculator.me.

This tool can help you figure out how much you’ll save in interest on your loans by switching from a monthly payment plan to a biweekly one.

5. I pay more than the minimum

I set my automated loan payments to withdraw more than the minimum amount each month. I can do this because I try to be responsible with my spending. I also prioritize putting money towards debt repayment so I can achieve my goal of paying off my loans faster.

By making a larger payment, the entire extra amount I pay goes towards reducing the principal. This brings my loan balance down much faster than if I just made the minimum payment—which would mean a hefty portion of my payment going toward interest. Since my principal balance falls faster, I also reduce the interest I’m charged each month.

Paying off student loans early is possible

Paying off student loans early isn’t something that everyone can do. It requires having the money to make extra monthly payments and deciding that this is the best use of extra cash rather than using the money for other things, like investing. However, if early repayment is made a conscious priority, it’s doable for most people.

If nothing else, most people can refinance their loans to save on interest and make repayment faster and easier. Doing so makes sense for private loans in pretty much every situation where you can reduce your interest costs since you don’t give up any federal borrower protections when you refinance private loans.

If you can take some of these extra steps, such as paying biweekly instead of once a month, you can accelerate the repayment process and become debt-free faster.

As I look at how much my student loan balance has declined in just a few years—and the date when I’ll become debt-free draws ever closer—I know that making the effort to pay off my loans early was the right decision.

About the Author

Nate Matherson is the co-founder of LendEDU, a website launched in 2014 as a resource for college students working to repay student loan debt. Today, LendEDU helps consumers learn about a variety of personal finance topics. Follow @GoLendEDU and @NateMatherson on Twitter!